SMARDEX – an innovative AMM reducing Impermanent Loss risks for LPs while offering lower transaction fees. Learn why it could be the next ‘Uniswap Killer’.

SMARDEX: The Evolution of AMMs

Yet, there’s something new on the horizon: SMARDEX (Symbol: $sdex), a trailblazing AMM specifically crafted to counter IL. Operating as an open-source smart contract, SMARDEX synergizes seamlessly with Ethereum Virtual Machine (EVM) compatible blockchains, such as Ethereum, Binance Smart Chain, Avalanche, Polygon, and more.

Countering Impermanent Loss: The SMARDEX Way

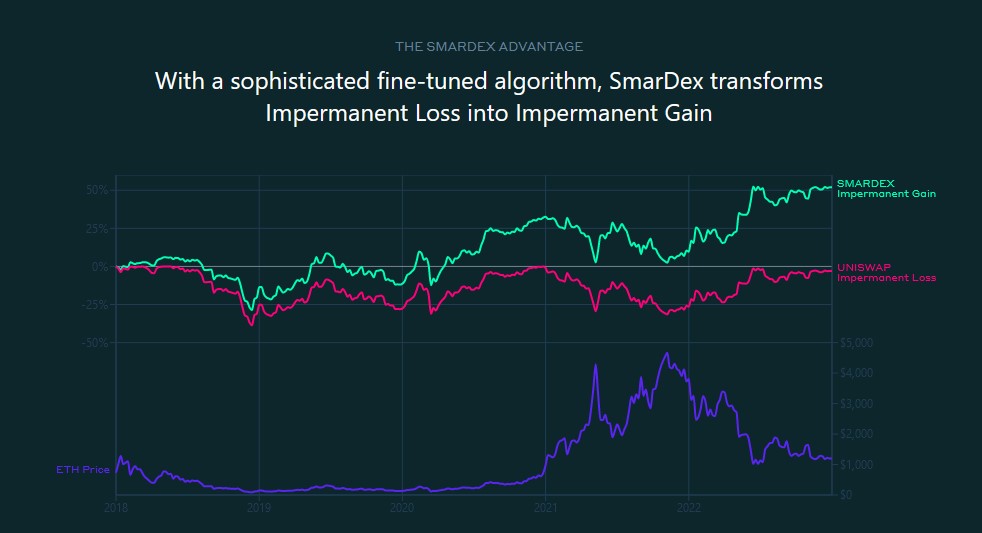

SMARDEX stands out with its innovative approach to combat IL, commonly a consequence of value fluctuations in the underlying asset of a liquidity pool. The repercussions of changing market prices often affect LPs and cause reductions in asset value.

An Exclusive Algorithm at Core

Resourcefully, SMARDEX has developed an exclusive algorithm that minimizes IL risk while enabling the creation of Liquidity Pools. This ingenious algorithm is rooted in the concept of ‘Impermanent Gain’, suggesting that the pool’s asset value can potentially increase over time, irrespective of constant asset market prices.

What Drives Asset Prices in SMARDEX?

To define optimal prices for asset purchase and disgorgement, the SMARDEX algorithm simultaneously considers the assets’ historical and market prices. Such a strategic approach ensures that LPs are duly rewarded for the risk they shoulder in providing liquidity to the pool.

Low Transaction Fees & Decentralization: Key SMARDEX Offerings

Boosting its appeal further, SMARDEX outshines competitors with its lower transaction fees, transforming digital asset trading into a cost-efficient practice for users. As a thoroughly decentralized exchange, SMARDEX excludes central authority control that grants users superior control over their assets, reducing the risk of censorship or fraudulent activities.

Roadmap

Roadmap looks solid and understandable

Big milestones are ahead, like:

• CEX listings

• Aggregators Integration

• Becoming a DAO

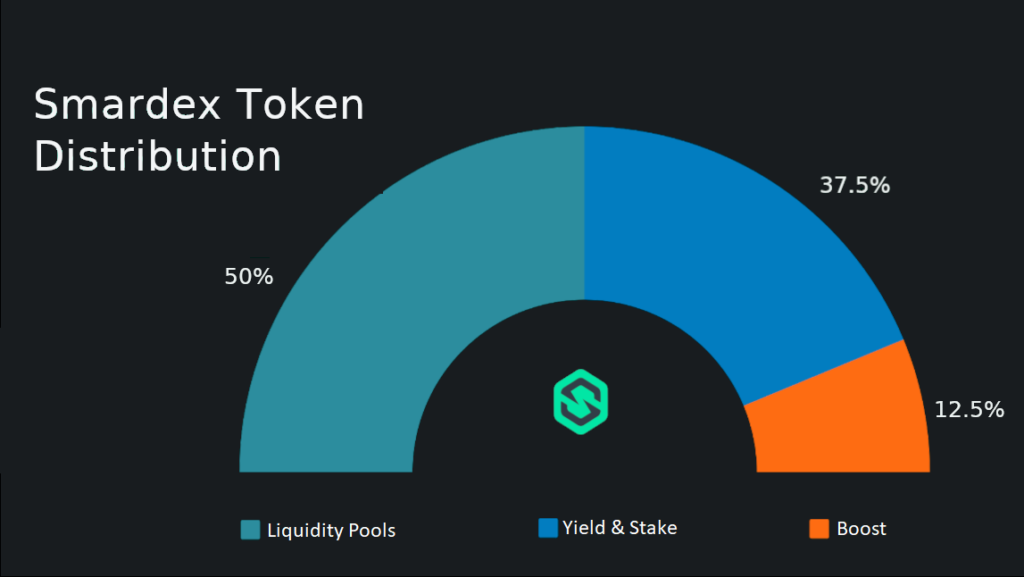

Tokenomics

Max supply: 10,000,000,000

SmarDex protocol strategy on token allocation is based on 3 pillars of liquidity providing

▪️ Liquidity Pools – 50%

▪️ Long-term Farming Yield and Staking Rewards – 37.5%

▪️ Boost period Farming Yield and Staking Rewards – 12.5%

No locked coins, nothing minted for the team. Everyone has to buy their SDEX like everyone else.

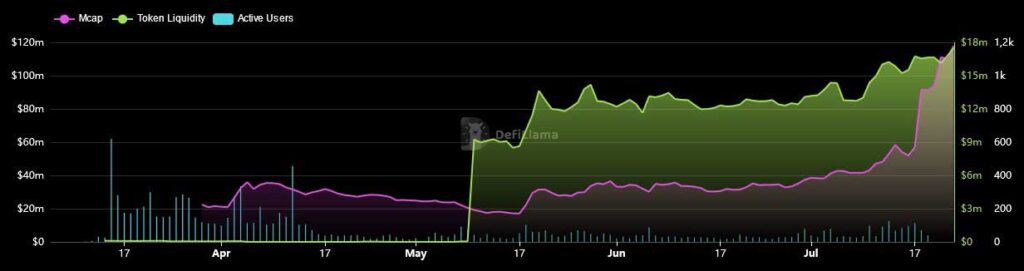

Market

▪️ Current Value: $0.0123

▪️ ATH: $0.0123 (23/07/2023)

▪️ CoinMarketCap ranking: #291 (On 2,7k+ Watchlists)

▪️ Max Supply: 10,000,000,000 $SDEX

▪️ MC: 78,4M

Conclusion: Why SMARDEX Could Be the Next Big Thing

Overall, SMARDEX is an encouraging debut in the AMM spectrum, offering creative answers to significant challenges faced by LPs in decentralized exchanges. With its groundbreaking algorithm and lower transaction fees, SMARDEX holds serious potential as a game-changer in the decentralized exchange domain and could be the next ‘Uniswap Killer’.

You can start buying $SDEX today on MEXC 👇

Useful Links

Website: https://smardex.io/

Docs: https://docs.smardex.io/

Twitter: https://twitter.com/SmarDex

Telegram: https://t.me/realSmarDex

Github: https://github.com/SmarDex-Dev/smart-contracts

CoinMarketCap: https://coinmarketcap.com/nl/currencies/smardex/